SMAs top growth among investment products, survey finds

In the past two years, separately managed accounts (SMAs) have experienced more growth than other investment product types, while mutual funds are stagnant, according to the recent Hearts &Wallets’ Investment Products & Asset Managers 2023 report.

Of the 123M U.S. households with assets (at least $100), 77% of households, or 95 million, are now aware of how their portfolios are allocated across saving and investment product types, up from 55% in 2013., according to the survey. A decade ago, individual investors were more aware of asset allocation than products. Today, the product awareness gap has almost disappeared, shrinking from 18% in 2013 to 2% in 2022, the survey noted.

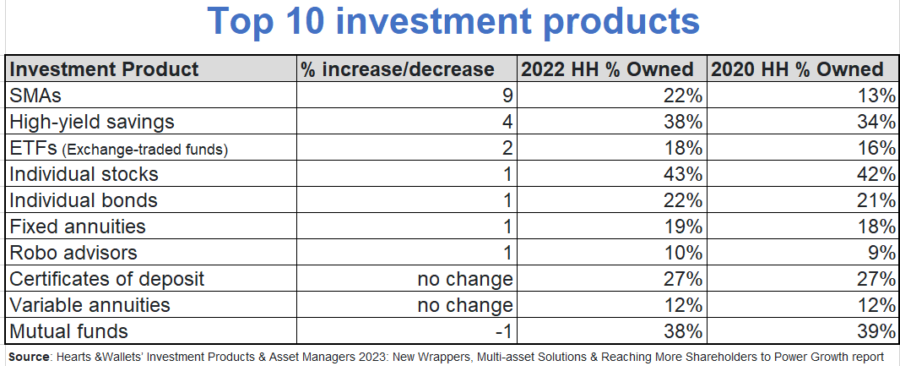

U.S. households reported individual stocks as their most commonly owned investment product[1], held by 43% of households. SMAs experienced the most growth among the top 10 products over the two-year period from 2020 to 2022: as follows:

Additional survey findings

Among the 95 million U.S. households who know their investment products, 59 million reported not owning mutual funds, according to the survey. Half of the 59 million households who are sure they don’t own mutual funds get equity exposure from other products, the survey pointed out.

In addition, SMA adoption is increasing significantly, particularly among wealthier households. Use of SMAs has nearly doubled in two years among households with $3M-plus in investable assets. It went from 22% in 2020 to 41% in 2022. These wealthier households with SMAs are also allocating more to SMAs, with a 29% portfolio allocation in 2022, up from 22% in 2020.

“SMAs, direct indexing and other new wrappers hold great promise for individual investors and the industry,” Laura Varas, Hearts & Wallets CEO and founder, said. “More individual investors are putting money into SMAs, and those who already own them are increasing their allocation to this product type. Conversely, the stagnation of mutual funds requires board-level attention.”

So, why have SMAs grown more than other investment types in the past two years? Part of the reason is that technology is helping open up SMAs to more individual investors, explained Varas. Once reserved for institutional investors and ultra-high-net-worth clients, SMAs have become more available to more investors, Varas added.

Tax advantages, personalization cited

Other reasons are the tax advantages and growing appeal of personalization that SMAs offer, which go beyond that offered by mutual funds, ETFs and other investment products where holdings from multiple investors are comingled. SMAs give the investor legal ownership of securities and offer fee flexibility, although there is still a fairly high hurdle for the initial investment.

And what are the implications of more SMA growth for advisors as they work with their investor clients? According to Varas, advisors can offer greater customization of a client's investment strategy, using SMAs and similar products, such as direct indexing.

SMAs also offer tax advantages over mutual funds, Varas said. How? “The mutual fund manager makes collective decisions for buying and selling sh0ares, dividend reinvestment, and distributions, which affects all fund investors the same way,” she explained.

“With SMAs, the manager can make such decisions on the account level and vary the approach by the individual investor," she said, adding, "Advisors can tout the increased ability to tax loss harvest with SMAs.”

There are also fewer embedded capital gains, which are often found with mutual funds. Wealthier clients are already embracing SMAs. Mass market clients are moving away from mutual funds. “Advisors need to think carefully about what investment products make the most sense to round out the portfolios of their clients,” Varas said. “Hearts & Wallets research has shown households that hold managed products handle the emotional aspects of market volatility better than households who have higher allocations to ETFs and robust in their portfolios.”

Target date retirement funds as income solution

In addition, the survey noted that target date retirement funds (TDRFs) hold potential as a “retirement income” solution, but currently TDRFs have decent penetration but low balances. Only 18% of households with assets report they own TDRFs and 13% are unsure. In addition, 77% of households who own TDRFs report balances of less than $100,000.

“Much work remains to be done to demonstrate whether TDRFs with income streams can be an effective solution to our national retirement security issues,” said Amber Katris, Hearts & Wallets subject matter expert and report co-author.

Also, according to the survey, cryptocurrency use has more than doubled, going from 9.4 million households in 2020 to 19.4 million in 2022. Crypto use is more sensitive to age than assets, and 3 out of 4 crypto users are under the age of 45. Today’s crypto users are likely to strongly agree that missing out on a possible growth opportunity is a bigger worry than losing money in the short term.

Fidelity, Vanguard Asset break through anonymity

According to the survey, Fidelity and Vanguard have the highest definite reach, or shareholder relationships, touching at least 9% to 10% of all U.S. households. Other fund families definitely reach only single-digit percentages of households[2].

The Hearts & Wallets Shareholder Certainty Score (SCS), which measures the portion of total possible shareholders who say that they are definitely shareholders, finds improvement at some fund families. Notably, American Century has achieved the most SCS improvement over 5 years, up 20 percentage points from 2018 to 2022 within the universe of shareholders who say they definitely own funds of the asset manager as percentage of all respondents who definitely own funds or may own but are unsure.

Satisfaction with investment products

Satisfaction with investment products is another important competitive measure, the survey said. 14 fund families exceed the industry average of 55% for high shareholder satisfaction with their investment products (high satisfaction, top-two box in 10-point scale). Harbor Funds (71%) and American Century (66%) lead the way, followed by Charles Schwab and Nuveen (both at 61%), Matthews Asia (60%), MFS Investment Management (58%), Vanguard, UBS, American Funds, Allspring (formerly Wells Fargo Advantage) and Janus (all at 57%), and Morgan Stanley and JP Morgan) (both at 56%).

“Improving shareholder certainty of ownership and satisfaction with investment products are critical, especially with the potential for merger and acquisitions among smaller asset managers,” Varas said. “Communications can go beyond required shareholder notices, prospectuses, and proxies. Certainty scores can be achieved with any distribution mix.”

The Investment Products & Asset Managers 2023: New Wrappers, Multi-asset Solutions & Reaching More Shareholders to Power Growth report is drawn from the section of the Hearts & Wallets Investor Quantitative™ Database and analyzes individual investor holdings of investment products, household allocation of investable assets, and asset managers leaders across the industry. The latest survey wave was fielded from Aug. 15–Sept. 15, 2022, with 5,993 participants.

[1]Excluding cash: checking accounts or cash/money market funds in brokerage accounts.

[2]The denominator of reach among all households includes those who do not hold mutual fund/ETF fund families.

Ayo Mseka has more than 30 years of experience reporting on the financial services industry. She formerly served as editor-in-chief of NAIFA’s Advisor Today magazine. Contact her at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Labor Department sets comment schedule for new fiduciary proposal

How insurance and regulation team up to address workers’ mental health issues

Advisor News

- Tariff uncertainty and volatility mark administration’s first six months

- How SECURE changed the rules for inherited IRAs

- Tips to help advisors sell long-term care insurance to younger prospects

- The future of Medicaid waivers under the ‘big beautiful bill’

- Letter: A looming health coverage crisis

More Advisor NewsAnnuity News

- Peak 65 consumers hit the pause button on retirement

- The Standard and Legacy Marketing Group Unveil EclipseMark FIA

- Finding the ideal customer for fixed and indexed annuities

- Integrity hires Said Taiym from Lockton as company’s first COO

- Nassau Financial Group Launches Innovative, Growth-Focused FIA: Nassau Athos Annuity

More Annuity NewsHealth/Employee Benefits News

- Lara expands mental health access

- Big, beautiful health insurance increases

- Colorado health insurers propose huge price increases following passage of GOP's federal spending bill

- Researchers at Mitsui Memorial Hospital Report New Data on Cardiovascular Research (Clinical Outcomes of Coronary Computed Tomography Angiography-derived Fractional Flow Reserve Dynamic-ffrct Registry One-year Analysis): Cardiovascular Research

- Union health plan sues Optum Rx for covering costly weight loss drugs including Wegovy

More Health/Employee Benefits NewsLife Insurance News